Early Adoption of ASC 606: first glance | Early Adoption of ASC 606: first glance - Audit AnalyticsAudit Analytics

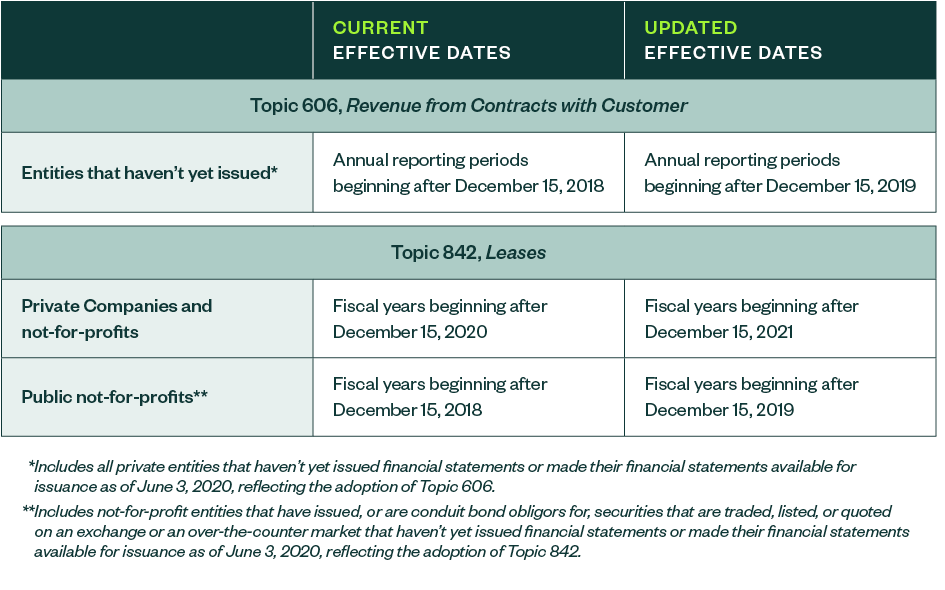

FASB Proposes Delaying Effective Date of Certain Standards Due to COVID-19 Pandemic - The CPA Journal

Selecting Modified Retrospective Transition for Adopting ASC 606 and Related Standards - The CPA Journal